- 1. Marketplace Overview

- 2. Business Model and Revenue Streams

- 3. Growth Dynamics & Platform Expansion

- 4. User Experience, Trust & Brand Power

- 5. Content, SEO, and Market Position

- 6. Product Diversification: Insurance, Glamping, Experiences

- 7. Competitive Landscape and Barriers

- 8. Lessons, Opportunities, and Pitfalls

- Conclusion

- 1. Marketplace Overview

- 2. Business Model and Revenue Streams

- 3. Growth Dynamics & Platform Expansion

- 4. User Experience, Trust & Brand Power

- 5. Content, SEO, and Market Position

- 6. Product Diversification: Insurance, Glamping, Experiences

- 7. Competitive Landscape and Barriers

- 8. Lessons, Opportunities, and Pitfalls

- Conclusion

How Outdoorsy Became the $3B Titan of Adventure Travel

Outdoorsy redefined the open-road adventure, transforming the way millions of people travel, experience nature, and monetize recreational vehicles. Launched in 2015 by Jeff Cavins and Jen Young, Outdoorsy grew from a grassroots RV sharing experiment into the world’s largest peer-to-peer RV rental, insurance, and outdoor hospitality platform. With $3B+ in lifetime bookings, annual revenue exceeding $35M, 25,000+ vehicles listed, and an international footprint across 11 countries and 4,800+ cities, Outdoorsy is a model for platform scale, market depth, and entrepreneurship in the experience economy.

1. Marketplace Overview

| Company Profile | Details |

|---|---|

| Name | Outdoorsy |

| URL | https://www.outdoorsy.com |

| Niche/Problem Solved | Peer-to-peer RV, camper van, and outdoor stays marketplace |

| Year Founded | 2015 |

| Headquarters | Austin, Texas |

| Monthly Visits | 1.0M+ (SimilarWeb, Feb 2025) |

| Listings | 25,000+ vehicles (2025) |

| Employees | Private company - not publicly disclosed |

| Lifetime Bookings | $3B+ (2024) |

| Annual Revenue | $35M+ (2025, estimated based on industry analysis) |

Key Milestones and Stats

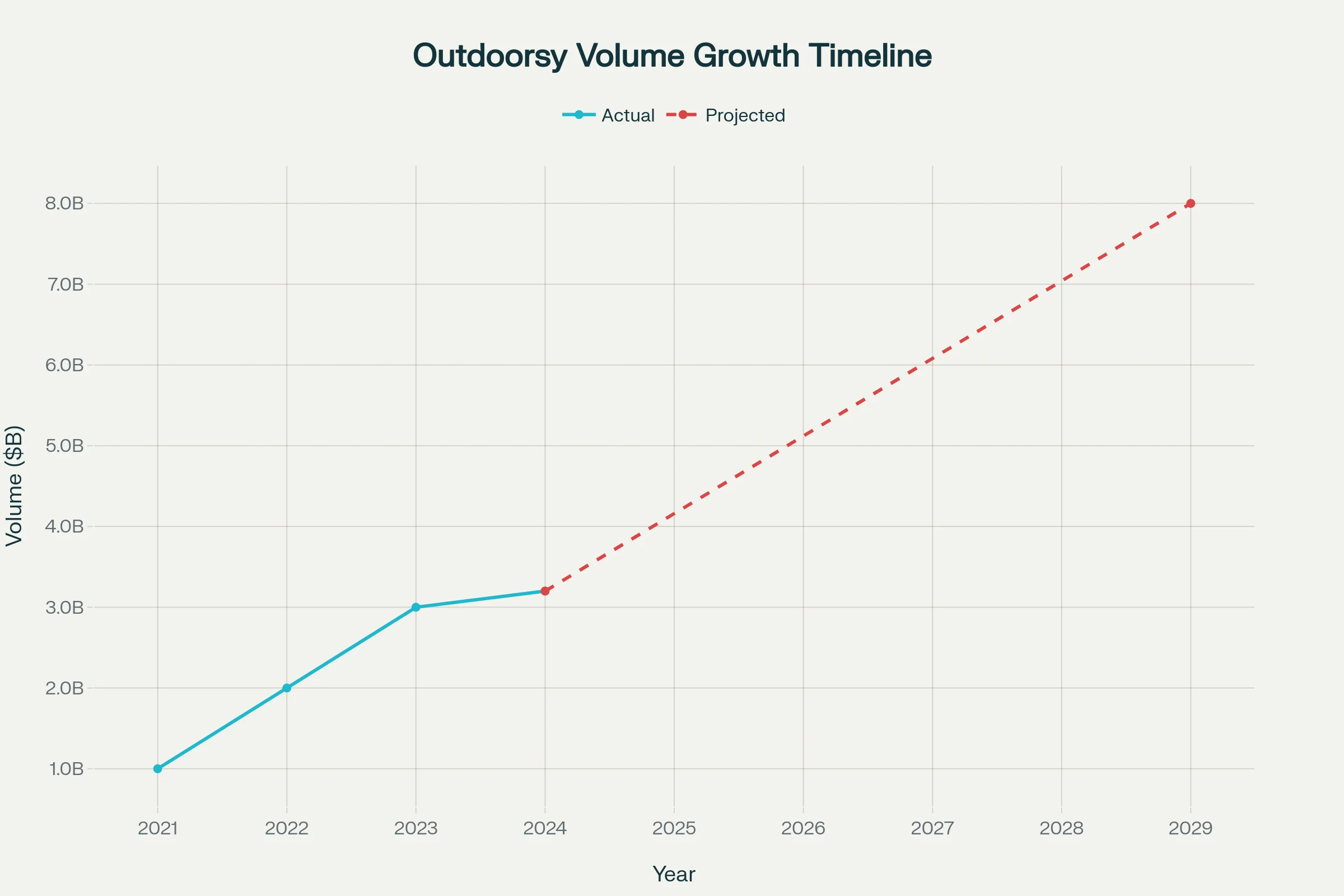

- Surpassed $3B in total bookings by 2024 (confirmed via company press releases); projects $8B by 2029 (company aspirational target).

- Over 1 million trips and 7 million booked nights since launch.

- Operating in 11 countries, 4,800 cities, and 14 markets (verified across multiple sources).

- Hosts earn $1B+ to date; customers log 250 million+ miles on rental RVs.

- Roamly insurance platform: ~$330M written premium 2024 (confirmed by Fast Company); projected $665M next 5 years.

2. Business Model and Revenue Streams

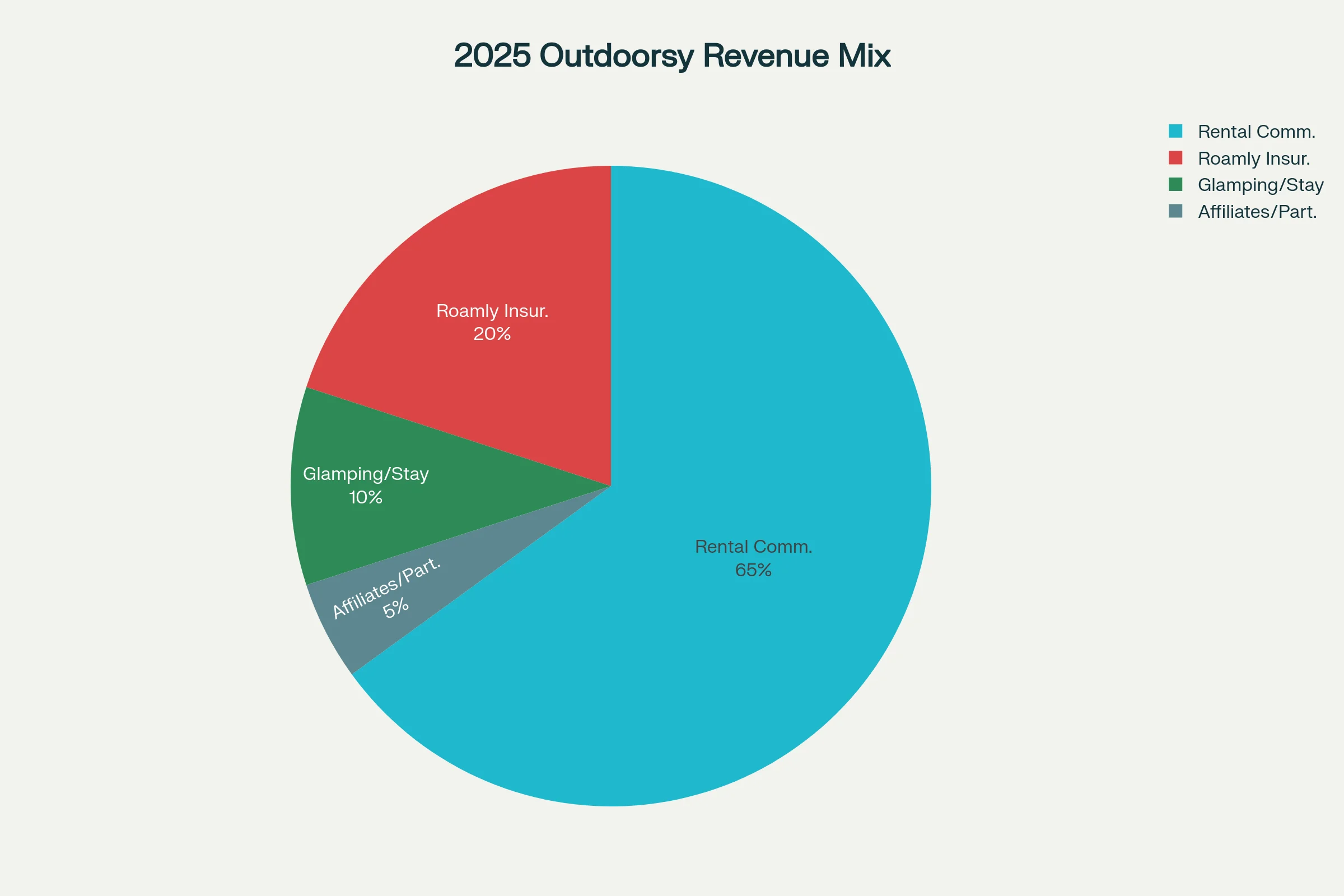

Marketplace: Outdoorsy operates a dual-sided platform. RV owners list vehicles for short-term rental (20-25% commission rate); renters pay a 5-15% service fee. Wheelbase Pro serves professional fleet managers.

Insurtech/Embedded Insurance: Roamly, Outdoorsy’s insurance arm, covers P2P rentals, fleets, and travel. It now supports other marketplaces as a standalone B2B insurtech.

Destination Network/Glamping: Outdoorsy Stays and its real estate arm invest in, own, and operate branded glamping sites (cabins, luxury tents, Airstreams) in markets like Yosemite, Texas Hill Country, and Colorado.

Affiliate & Partnerships: Travel affiliate program, co-branded experiences, third-party travel product placements add incremental revenue.

3. Growth Dynamics & Platform Expansion

- Record growth through the pandemic, with bookings doubling 2021-2023.

- Product and service expansion; Wheelbase Pro (B2B), Roamly insurance (~$330M premium run-rate), glamping/retreats in top nature destinations.

- Active internationalization: available in US, Canada, Australia, New Zealand, UK, Germany, France, Spain, Italy, and more.

- Major press/awards: Fast Company World's Most Innovative Companies, Inc 5000, Forbes Startup Employer, Goldman Sachs Entrepreneur Honoree.

- Achieved profitability in 2023 (confirmed across multiple business publications).

🚀 Want More Directory Success Stories?

Get weekly insights on profitable directories, growth strategies, and monetization tactics delivered to your inbox.

Subscribe to Directory Gems

4. User Experience, Trust & Brand Power

- Seamless P2P booking, verified owner/renter checks, secure payments, 24/7 support, transparent pricing.

- Roamly insurance plus full suite of extras (roadside, liability, trip cancellation).

- Highly rated: 4.4/5 stars on Trustpilot (23,000+ verified reviews).

- 92% 4+/5-star customer reviews.

- Offers delivery, setup, and pickup at locations like national parks, campgrounds, luxury retreats.

- Full spectrum: from budget-friendly trailers to $300K+ luxury motorhomes and boutique glamping.

5. Content, SEO, and Market Position

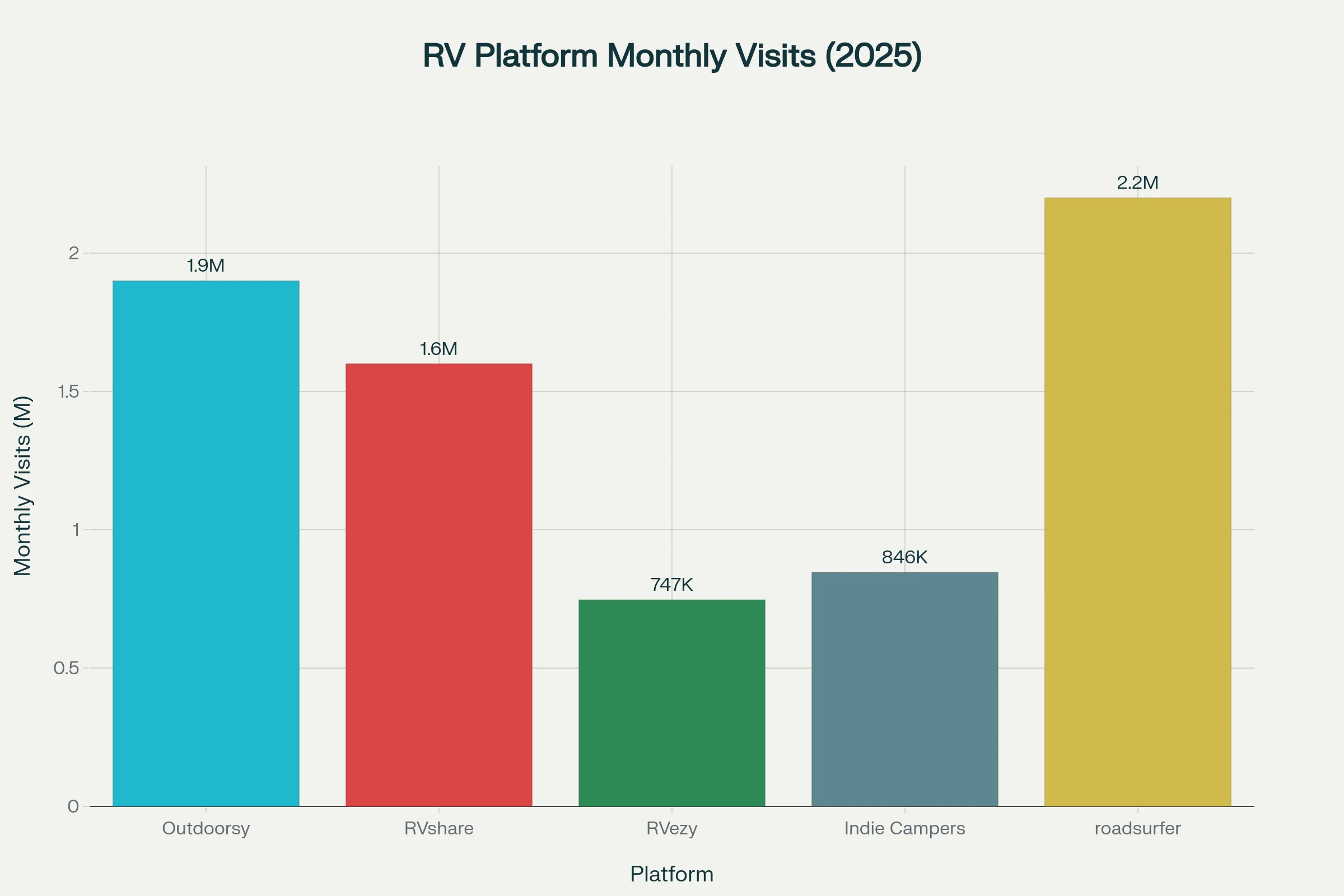

- 1.0M+ monthly visits (Feb 2025, SimilarWeb).

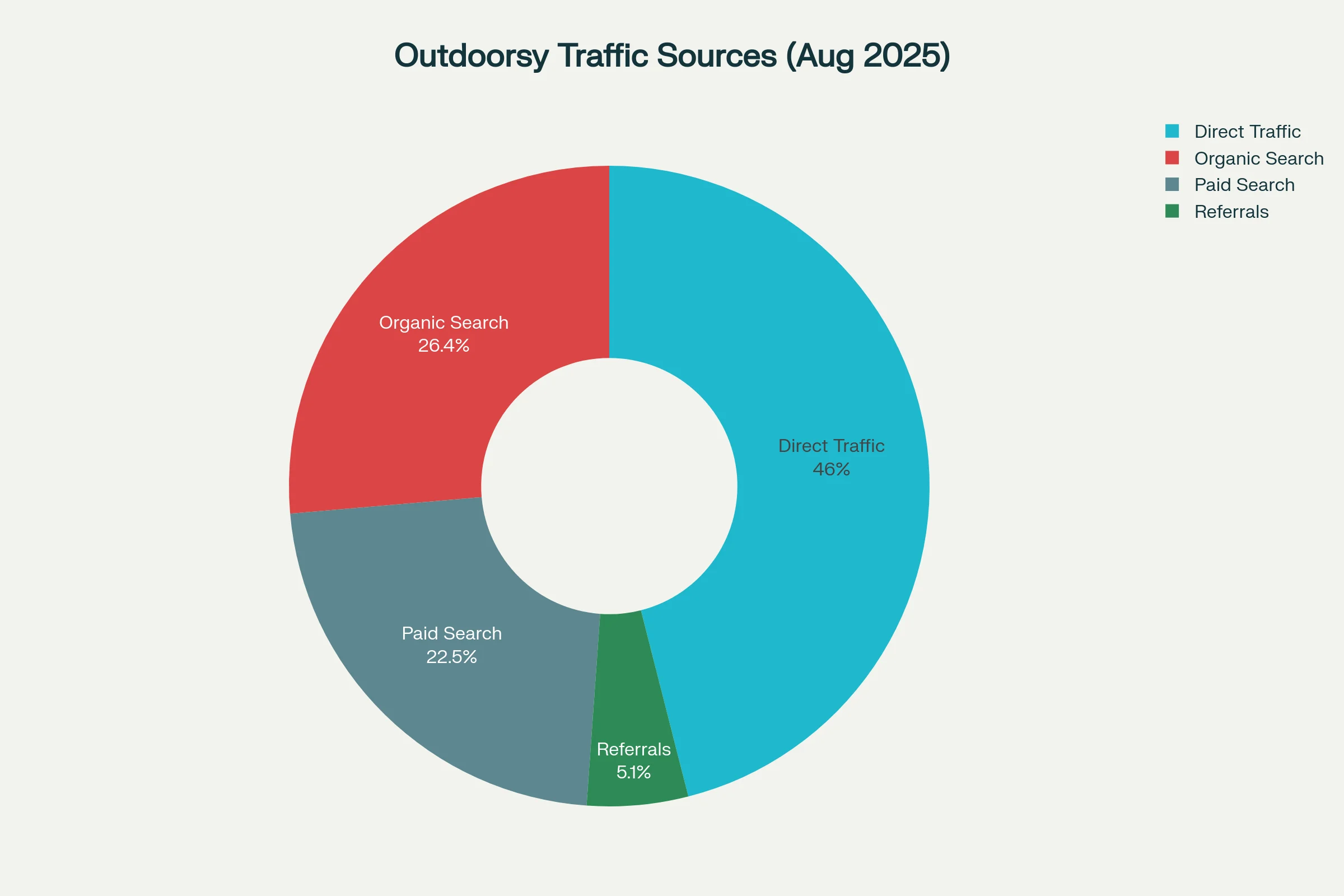

- Direct traffic leads (46% share), followed by strong organic presence (26%).

- Top keywords: outdoorsy, rv rental, rent an rv, outdoorsy affiliate program, glamping Yosemite, etc.

- Category rank: #8 in Car Rentals (US); #19,263 globally (2025).

- Competes directly with: RVshare (1.6M), Indie Campers (846K), RVezy (747K), roadsurfer (2.2M), Hipcamp, and more.

- Roamly insurance is now embedded in other marketplaces.

6. Product Diversification: Insurance, Glamping, Experiences

- Roamly Insurtech: Now a major B2B revenue driver ($330M+ premium 2024, 200%+ YoY growth). Offers both marketplace insurance and SaaS to pro operators.

- Outdoorsy Stays: More than just RVs—cabins, luxury tents, unique accommodations (Airstreams, yurts, treehouses).

- Glamping Expansion: Major investments in luxury glamping retreats near Yosemite, Bass Lake, Texas Hill Country, and more; partnerships with UnderCanvas, Thousand Trails, Collective Retreats.

- Affiliate Network & Experiences: Expanding co-branded booking, referral trail, loyalty rewards, destination experiences and activity add-ons (ATVs, outdoor sports, curated tours).

7. Competitive Landscape and Barriers

- Peer-to-peer RV rental is dominated by Outdoorsy and RVshare, with new European and Asian entrants scaling.

- Barriers: proprietary insurance (Roamly), deep owner supply, differentiated user experience, loyal community, global presence, M/L on utilization/pricing.

- Defensive moats: platform trust, embedded insurance, multi-sided network effects, robust global route coverage.

8. Lessons, Opportunities, and Pitfalls

Defensibility:

- Platform network effects; insurance/fintech embedding; first-party real estate and hospitality.

Risks:

- Category fragmentation, local regulations, macroeconomic travel shocks, dependency on insurance underwriting margin.

Opportunities:

- Further internationalization (Europe, Asia-Pacific); vertical SaaS for owner/pro hosts; glamping and stay expansion; additional B2C hospitality products (travel insurance, activity bundles, exclusive site launches).

Conclusion

Outdoorsy's journey from backyard experiment to platform titan is a model for experience marketplaces. Blending recursion (P2P rental+insurance), hospitality (Stays/glamping), and B2B SaaS, Outdoorsy demonstrates how you can scale a sharing-economy business—even in a regulated and asset-heavy category—into a global network with deep financial and cultural impact. Their relentless focus on customer experience, insurance innovation, and global ambition positions them to define the next decade of experiential travel.

🚀 Ready to Build Your Own Directory?

Join 80+ entrepreneurs getting actionable insights on directory businesses, case studies, and proven growth tactics.

Get Free Directory Insights

Explore Related Categories

Data Sources: This case study is based on company press releases, SimilarWeb analytics, Trustpilot reviews, and industry reports. Financial figures represent estimates based on available market data and third-party analysis. Traffic data from SimilarWeb (February 2025). Customer ratings from Trustpilot verified reviews.